The North East is famous for its walls – Hadrian’s is probably the best known but various town and city walls across the region are also of great historic significance.

Every year, millions of people visit them and marvel at the engineering skills displayed by their construction.

However, a similarly impressive set of walls has been built in recent months and the work has gone almost completely unnoticed.

With a combined length of more than a kilometre, reaching almost 8.8 metres at the highest point and with a surface area in excess of 4,800 square metres, the seven retaining walls now approaching completion at The Rise housing development, in Scotswood, are believed to be the biggest such structures built in the UK in recent years – and there are nine still to build.

They are creating a series of terraces on the steeply sloping Tyneside valley – allowing the construction of new homes which are part of a major regeneration programme in Newcastle’s west end.

The impressive engineering feat is being delivered for the New Tyne West Development Company (NTWDC) a public-private partnership comprising Newcastle City Council and Keepmoat Homes. It is driving a £265 million project to deliver around 1,800 mixed tenure homes on the 148 acre site. To date just over 400 have been completed.

Director, Lee McGray, said: “This work has been steadily progressing for several months, almost unnoticed. However, it deserves to be recognised as major piece of civil engineering, which is enabling the safe and cost-effective redevelopment of this steeply sloping site.”

Several specialist companies were engaged to determine the best solution – 3E Consulting Engineers, Retain Solutions the retaining wall contractor, Remedy Geotechnics provided the detailed design and construction drawings for the reinforced soil walls and HMH Civils the groundworks and specialist civil engineering works.

McGray continued: “After a huge amount of on site testing, technical planning and computer modelling, it was decided that, rather than cut into the hillside, terraces should be created using an Allan Block system, which met the overall stability requirements and offered lower ground bearing pressures.”

Allan Block systems are manufactured and supplied in the UK by Colinwell Masonry.

Remedy Geotechnics Technical Director, Daniel Simpson, explained: “These are really quite big walls. I’m not aware of anything of that size being built in the UK recently. There was quite a lot of analysis involved, and we used a lot of test data in the detailed design of the reinforced soil retaining walls.

“This is a modular system, utilising specifically designed hollow blocks. Starting from the bottom, a layer of blocks is set on a levelling pad and the drain is placed behind. Granular fill is added and compacted up to the top of the block and the first layer of geogrid is laid. The process is then continued until the required height is reached.”

The first seven walls so far created have enabled the second phase of housebuilding at The Rise to get fully underway. The remaining nine walls will be completed as up to 1,400 more new homes are delivered.

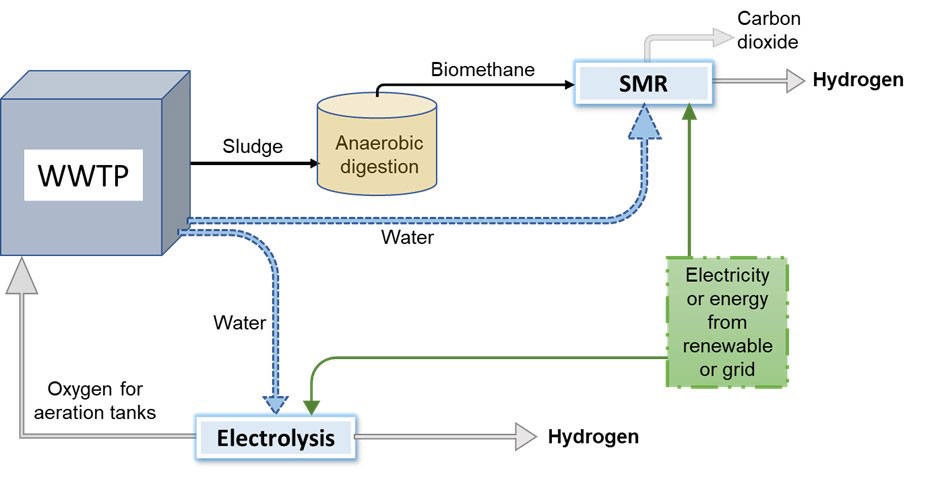

Report author Kim Wu, a research analyst at BlueTech Research explains: “Water demand could be a concern for the large number of green hydrogen projects being planned, particularly for water utilities and councils, or in water-stressed areas as some hydrogen projects might expect to use tap water supplied by local utilities.

Report author Kim Wu, a research analyst at BlueTech Research explains: “Water demand could be a concern for the large number of green hydrogen projects being planned, particularly for water utilities and councils, or in water-stressed areas as some hydrogen projects might expect to use tap water supplied by local utilities.