Joe Beeton of Construction Dive reports on a recent USA survey.

Modular Monitor: How GCs, trades and architects view offsite construction, by the numbers

Survey responses from Dodge show that the professions are aligned on some aspects and at odds on others. Here’s what the data might mean for the future of offsite.

Since Construction Dive began taking the pulse of offsite construction, this column has been inundated with praise for the method from self-identified modular builders.

Modular-focused firms are putting together vertically integrated business models, handing over keys to turnkey buildings and even calling the movement disruptive.

But modular builders likely can’t move the needle on their own, so the focus is different for this month’s column: modular’s other stakeholders.

While there are over 200 modular builders in the U.S., according to the Modular Building Institute, commercial modular building only accounts for about 4% of the market. It would take sweeping buy-in from traditional contractors, designers, owners and all applicable trade professionals for modular to be defined as an industry disruption, or a “major disturbance in the way things are done,” as Ivan Rupnik, an associate professor at Northeastern University’s School of Architecture, puts it.

Owners may be the most pivotal, because they conceive and fund projects, and if a build is going to be modular, it has to be modular before shovels hit the dirt, according to Laurie Robert, LEED AP and vice president of modular building specialist NRB Inc. in Canada.

Who’s making way for modular?

While Robert also expressed the common sentiment that lack of education among owners often inhibits modular’s take-off, it’s important to note that there seems to be a certain threshold for a tipping point: Once owners are convinced, they go out and actively champion it.

But what about architects, construction managers and subcontractor groups such as erectors and building enclosure trades? What do they seem to agree on, and where do they differ?

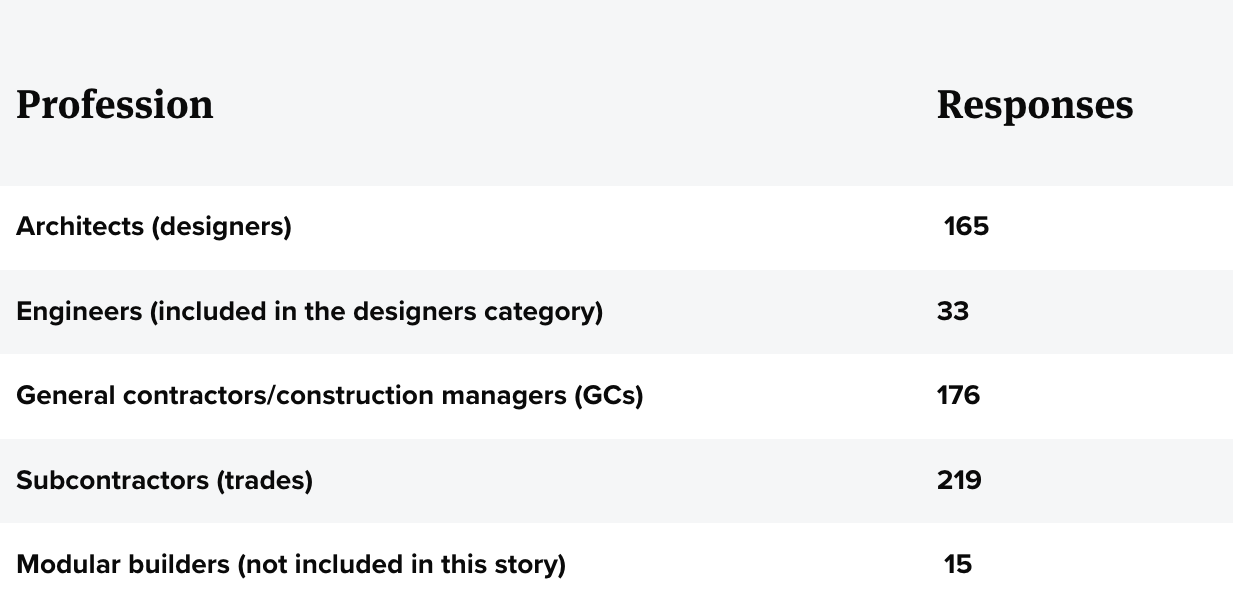

To that end, Dodge Data & Analytics recently released a report that culled together thought leadership on modular and prefabrication, such as the observation from Rupnik, and recorded results from a survey on modular construction that elicited responses from more 600 AEC professionals ranging from designers to steel fabricators.

To participate, respondents had to have worked on at least one project that involved prefabrication elements or full modular construction in the last three years. Of that pool, only 15 identified as modular builders or manufacturers, and their answers were recorded separately.

As a publication that’s trying to shine light on the industry’s more comprehensive and often varied views of modular, it’s refreshing for Construction Dive to see a vast array of tangential stakeholders weigh in on the topic.

Answers were broken out by three professions.

Analysis shows how much they dovetail on myriad sentiments and also some of the ways in which they contrast.

General contractors that responded, for example, overwhelmingly showed support for offsite building methods. That may not be a total surprise, considering that last month we heard heavyweights that have made their name in traditional stick building, such as Mortenson and DPR, talk about benefits they’ve had with offsite construction.

But it’s important to consider where GCs’ stance fits among other stakeholders in the built environment.

For one, this was the group that most forecasted increased use of full-volumetric permanent modular construction. A slight majority predicted only 25% or less of their projects being composed of mostly flat-packed or 3D modules built offsite in the next three years. But more importantly, a quarter of that group said they’ll be using the method on more than half of their projects. Only 13% anticipated no involvement at all.

Where does modular make sense?

Out of 14 market segments, GCs found medical facilities the most promising for modular construction. Forty-one per cent selected healthcare as being in the top 10 most-promising sectors, which represents a higher volume than any other category. Respondents were going out on a limb on their healthcare predictions, because that number is double the percentage of firms that ranked it as one of the top building types they’d done through modular means in the past three years.

Healthcare ranked similarly for the 219 trades representatives that responded. Like the GCs’ rankings, it also came in as the subs’ strongest category for modular growth, with 56% crowning it in their top 10 despite only 31% putting it in that class when looking back.

But the consensus of contractors and subs differ from that of designers, who stand behind multifamily as the strongest contender for increasing modular inroads. Half of the more than 200 architects and engineers polled ranked it in one of the top spots, despite only 16% saying it’s been one of the most prominent categories in recent years.

Multifamily is perhaps the biggest enigma of the report. “Design firms,” for instance, according to co-authors Stephen Jones and Donna Laquidara-Carr, “are extremely positive about the role of modular on multifamily projects going forward,” and the numbers back that up.

Trades, on the other hand, more frequently ranked it as being significant in the last three years yet not nearly as likely to hold such importance in the next three. GCs’ take seems to be that it will taper slightly but remain about the same, with only 33% saying it has been and will continue to be one of the top building types for modular.

GCs and trades are also more optimistic about modular in the hospitality segment, with it coming in second and third in that same index, respectively, for the next three years. Designers, on the contrary, anticipate the sector’s use of modular slowing.

Error, group does not exist! Check your syntax! (ID: 6)

What’s driving offsite’s growth?

For all groups, the “desire to increase productivity” reigned as the most important factor influencing the move to offsite in the past three years, according to Laquidara-Carr and her team’s findings, though builders and subs ranked productivity gains even higher than designers, likely because of how it impacts their workflow.

“Remaining competitive” was the second-most influential factor among all three, and even more so for subs.

“Interestingly,” the report notes, “design firms report having been most highly motivated by seeking improved cost performances (58%) — out [pacing] both GCs/CMs (49%) and trades (50%).

“This,” the findings continue, “ … [indicates] that architects and engineers understand both prefabrication and modular construction can have a positive influence on cost control and should lead to more development of design solutions that consciously enable both.”

What’s holding modular back?

The rub, however, is that designers forecasted the lowest overall percentage of prefabricated assemblies usage in the coming three years. Only 16% anticipated use of prefab components such as behind-the-wall plumbing assemblies for headwalls or multi-trade assemblies such as above-the-ceiling corridor racks in hospitals, as opposed to full-volumetric room modules.

This means, the authors wrote, that designers need “to become more engaged with designing in a way that enables contractors to implement prefabrication.”

Getting on the same page in the development of both prefabricated assemblies-based and module designs takes teamwork, and the culture needs to change, NRB’s Robert said. “The formation of your team, including the owner, the architect, the general contractor, the modular builder and all other stakeholders,” she continued, “is certainly the most important aspect of a modular project’s success.”

Luckily, for the sake of modular’s advancement, there are many things to agree on. All three groups leaned into the idea that modular construction improves project schedule performance, with that factor resonating as the biggest driver for growth. Around half of each groups’ respondents believed modular reduces project costs enough to consider it a highly influential factor in stirring up demand.

But GCs didn’t agree with most subs and designers on modular’s penchant for improved quality as being a top driver. Only 34% believed it will play an important role, whereas half of the designers and half the subs said it’d have an increasingly high level of influence.

Another area in which all groups aligned included their take on what’s inhibiting modular growth the most. Owners, as noted, are still one of the biggest influencers on whether industry players toying with offsite tactics actually employ them on projects or not — and that’s true for all groups, with each ranking “lack of owner interest” a top obstacle.

Kendra Halliwell, associate principal of the women-owned Icon Architecture, also previously expressed the fact that availability of modular factories, or lack thereof, can be a big determinant in whether a modular project gets greenlit. That’s even more evident for designers, according to the report, with half of that group ranking it as a huge setback to growth and GCs trailing slightly in that opinion.

“One thing I want to emphasize is, if you’re doing a modular project, to visit the factory at least once a week while it’s being constructed,” the AIA and LEED AP architect said during a case study presentation of her firm’s first modular build, the 171-unit, 129-module The Graphic Lofts, Boston’s largest modular multifamily development. “We didn’t plan for that, and we ended up having to make up for that. We did, however, meet three times a week — sometimes through virtual meetings — with the architect, contractor and modular manufacturer.” Proximity to the factory is key, she said.

Trade contractors, however, don’t see availability in the same light. Only about 23% considered it a problem, but that could be because trades “are not as involved in sourcing suppliers,” according to the report.

How are supply decisions made?

How players select modular construction services is another eye-opener. “Design firms and GCs most highly value expertise,” the report found, but “design firms are far more influenced by owners on their modular supplier decisions than GCs.”

“Price,” however, “is not a highly influential factor for selection of a modular construction supplier,” for any groups using full-volume modular builds, the authors found, noting that it will likely be more of a factor as more and more suppliers enter the market.

But that’s different from what respondents had to say about the supply of prefabricated components and services. “This contrasts with prefabrication, where it ranked second overall on this same list of six factors and was cited as the primary influencer by 20% of GCs/CMs,” the report noted. “This may reflect the different maturity levels between these two markets, where because there are more suppliers available for prefabrication, price can be more readily used for competitive evaluation.”

Yet a different take is that some builds involve a combination of both full-module rooms and single- or multi-trade prefabricated assemblies, or combine those offsite elements with traditional methods, otherwise known as hybrid builds. Robert, concurring with another common perception, espoused the value of hybrid models.

And it’s in hybrid or prefab work where many subs shine. While they are involved in full-volume modularization jobs as well, they often are the most heavily invested when it comes to any other jobs that require at least partial panelisation or prefab components.

The study notes that “trades can often make the decision to prefabricate their part of the work without significantly impacting or involving other trades.” Subs seemed both the most well-versed in prefabrication when looking back at the past three years and also the most enthusiastic about the next three.

Subcontractors often have to put their workers’ necks on the line, so modular’s purported safety benefits hold a lot of water for subs. “Safety scores far higher with trade contractors because of its direct impact on their workforce,” the report said.

Source: Construction Dive

Leave a Reply

Want to join the discussion?Feel free to contribute!